While many Oregon homebuyers use traditional loan sources like banks, mortgage brokers or credit unions, there are good reasons (and a very helpful alternative) to purchase property without them. Buyers avoid traditional lenders for different causes and when they do, one mechanism they frequently turn to is seller financing, also called owner financing.

What Is Oregon Seller Financing?

In the state of Oregon, seller financing is known by a host of different names with essentially the same meaning. For example, it might be called Oregon owner financing, Oregon seller terms, Oregon owner carry, Oregon seller carryback, Oregon owner carryback, Oregon seller carry, or simply ‘carrying paper.’ In a nutshell, Oregon seller financing allows a homebuyer to purchase a property by making an initial down payment, then make remaining payments to the seller over time. Oregon has rules in place especially to regulate large-scale property sellers who might handle a significant amount of seller-financed transactions (notably commercial firms, such as private finance companies). The process still remains relatively simple for typical Oregon home buyers and sellers who enter into a home sale without using a traditional lender.

Fundamentals

A key factor that makes seller financing an option is if a homeseller has either no existing loan, or a very small loan remaining on the property to be sold. Having little or no loan on the home being sold means more of the buyer’s down payment will go to the seller, not diverted to the lender of a seller’s existing home loan. Most home loans now have what’s called a ‘due on sale’ clause, which means a seller’s existing home loan must be paid off upon the sale of a property. The single factor of having no or little loan balance on a property is often the main limiting condition in determining if seller financing is a realistic option. If the property has either no loan, or only a small loan remaining, this can really open the door to seller financing.

Playing the Bank

One other factor for prospective sellers to consider when thinking about seller financing is if they’re okay with ‘taking payments’ instead of receiving a ‘lump sum.’ By ‘playing the bank,’ sellers receive payments from the buyer as they are made over time, not all at once. Some sellers greatly prefer the regular income of proceeds from their home sale over time. That said, unless the payments are made according to a ‘straight line’ amortization, there usually will be a lump sum paid to the seller at the end of the agreed upon term, often after several years, or much longer.

Seller Financing is the ‘Swiss Army Knife’ of Real Estate

Basic Tools

Several tools can be used to establish seller financing. In Oregon, these include either a trust deed and note, or a land sales contract. Here’s an article outlining some differences between these two instruments for Oregon seller financing. Most common is the trust deed and note, which can be prepared by Oregon title companies and escrow firms.

Less common in Oregon but also suitable is the land sales contract, which is frequently more expensive, since Oregon land sales contracts can only be drawn up by an attorney. Another difference is how a buyer takes title. ‘Equitable title’ is an ownership interest used in land sales contracts when property remains in the seller’s name and ‘legal title’ commonly describes interest in a trust deed and note.

Harnessing The Power of Oregon Seller Financing

The terms seller financing or owner financing may sound ‘ho-hum’ to some, but they can be very powerful. How else to describe a real estate tool that can:

- Make an otherwise ‘unsellable’ property sellable, and/or

- Render an otherwise ‘unqualified’ buyer qualified, whilst escaping considerable loan fees, underwriting and requirements, like an appraisal, and/or

- Provide income to a home seller, with interest, all secured with the protection of a legal instrument in case of default, and/or

- Allow a homebuyer the ability to purchase a home while selling a less liquid (hard to sell) asset, or re-building credit, and/or

- Give both buyer and seller the flexibility to negotiate what works for them, rather than a bank’s pre-determined, ‘cookie-cutter’ loan term, interest rate, or myriad other conditions.

In this section we’re addressing the basics. That’s because there are other important elements, such as specific owner financing insurance coverage. Yet for now, here are a few scenarios illustrating some ‘real life’ advantages of seller financing.

Scenario #1 involves a house located in a large Oregon town with no foundation and a faulty roof.

This property is otherwise attractive, yet routine lender guidelines require a foundation for residential properties. As a result, buyers cannot get a loan to buy the property, so it sits, unsold. The seller begins to think his house is a ‘lemon.’ That is, until he learns that since he owns the property ‘free and clear’ with no loan on it, he can sell the property directly to a buyer with seller financing. Before long, a buyer who happens to be a contractor discovers the house and realizes he can put a roof on the house for the cost of materials, then hire foundation work far more cheaply than someone who isn’t in the building trades. An agreement is made and the transaction closes. Buyer and seller both see the transaction as a ‘win-win.’

Scenario #2 involves a home located in a small Oregon town between the Willamette Valley and Oregon Coast.

Given the somewhat remote location and unique floorplan of the home, there isn’t a lot of demand for the property in Scenario #2. In an effort to ‘open up the buyer pool’ and ‘jumpstart’ buyer activity, the seller’s Realtor advises his seller client to consider seller financing.

The seller agrees and before long, a California buyer who just retired discovers the property, located near the buyer’s elderly relative. The buyer wants to first sell his large ranch in California, but because he will be listing his out-of-state property for 4 million dollars, the buyer knows it may take more than a few months to sell it. The California seller doesn’t want to sell his out-of-state property at a discount and meanwhile wants to purchase a home near his relative.

So the Californian strikes a deal with the small Oregon town homeseller. Because the seller is open to seller financing and therefore providing the buyer with a helpful benefit, including no need for a lender required appraisal or loan fees, the buyer agrees to pay full price for the seller’s property and places $100,000, or 25% down of the $400,000 purchase price using seller financing. Confident his California property will sell within 3 years, buyer and seller agree to mutually agreeable monthly payments, with a balloon payment of the remaining loan balance within 36 months.

The seller gets full price, a quicker home sale, loan interest (on top of the full selling price) and the security of a legal instrument as protection in the unlikely event of buyer default. The buyer has sufficient time to sell their out-of-state asset, plus can move quickly to live near his Oregon relative. As a result, buyer and seller both see the transaction as a ‘win-win.’

Scenario #3 involves a homebuyer who recently experienced a ‘short sale’ on an investment rental he owned.

Because traditional lenders are unlikely to loan to borrowers with a recent ‘short sale,’ this homebuyer can either wait possibly years until lenders are satisfied that this experience is well behind him, or look at other options. Knowing his buyer’s situation, the Realtor for this ‘short sale’ purchaser searches specifically for, then locates a property suitable for his buyer client which is being offered with seller financing. The buyer’s Realtor writes up a clean, solid offer with 20% down at a competitive interest rate and 5 year term. The seller accepts the ‘short sale’ buyer’s offer. There is a successful closing of the transaction, long before a traditional lender would have said ‘yes’ to provide the ‘short sale’ buyer with a home loan. Buyer and seller both see the transaction as a ‘win-win.’

Covering the Bases

As with any business agreement, business agreements can and sometimes do go wrong. One important factor for sellers to consider prior to entering into any seller financing agreement is the possible default by a buyer, who may not continue making payments as agreed. In this case, placing the situation before an Oregon real estate attorney is frequently a good move. If the buyer is dealing in good faith, sometimes a temporary restructuring of payments can be agreed upon, or mutually agreeable exit strategy to provide the buyer a pathway to meet the agreement, or sell the property. If the buyer becomes difficult, an attorney’s letter can be persuasive.

Happy Bankers

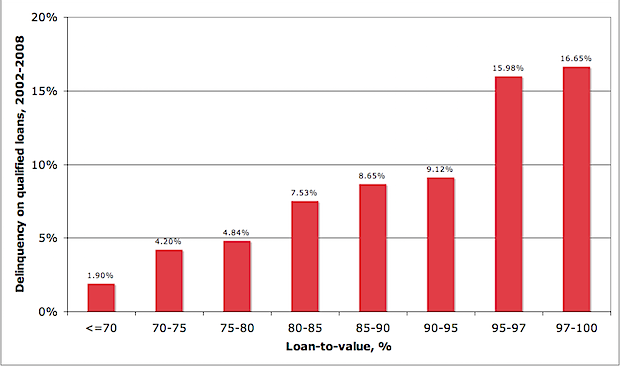

Studies show that traditional lenders start relaxing requirements when a buyer can make a 20% downpayment, known as 80% ‘loan to value.’ This is a good general rule for seller financing, too. A minimum 20% downpayment typically means a buyer will be a better risk. The graph below shows how such an 80% ‘loan to value’ situation has historically reduced the delinquency rate for loan transactions.

Insurance

One other condition for sellers to be aware of relates to insurance. This can include fire and liability insurance. Especially helpful is if the seller is named as a co-insured or ‘loss payee.’ This means that if there is a loss, such as a fire, the seller has a priority to insurance compensation.

New Rules

Federal and state mortgage laws often change and this is certainly true of Oregon seller financing. The good news is that for many routine transactions, Oregon homebuyers and homesellers can participate in the benefits of seller financing.

The latest batch of regulations are largely designed to hold commercial lenders more accountable. If a homeseller is not a major creditor or commercial lender, the process of buying and selling with seller financing in Oregon can still be relatively simple. The latest rules create a situation where it’s best to be clear if you’ll be dealing with a ‘vanilla’ type ‘mom and pop’ seller financing transaction, or a more complicated ‘corporate’ one that requires additional time, money and outside assistance.

The following information is not legal advice, but a ‘thumbnail’ overview of two simpler scenarios for Oregon seller financing. For real estate advice, consult a Realtor. For legal advice, consult an attorney.

The ‘Vanilla’ Scenario

Let’s have dessert first. One of the easier scenarios for Oregon seller financing or owner financing is if you’re buying a home from a seller who has lived in the house as a primary residence. This simple factor is a decent sized ‘green light’ and avoids much additional paperwork, like the need to hire a mortgage loan originator, or MLO, to handle the seller financed transaction. Under the new rules, another ‘vanilla’ scenario that simplifies the process are transactions between family members.

The ‘Small Potatoes’ Scenario

Even if the seller has never lived in the home you’re buying, if the seller is deemed ‘small potatoes’ and not a major creditor or commercial lender, the seller can still provide seller financing. In this case, a ‘green light’ to simplicity is found among sellers who have provided seller financing in a home sale for three or fewer transactions within a 1 year period. This exemption is helpful, since few residential homeowners sell even one home each year.

The Meat of the Matter

Regardless of the kind of seller financing you decide upon, consider ‘beefing up’ your chances by working with a professional experienced in this unique area of real estate practice. Seller financing offers many potential advantages, but it’s important to understand the process and your limitations.

Collection Escrow Account

One very convenient service often used by buyers and sellers who use seller financing is called a collection escrow account. Collection escrow accounts are usually set up during the escrow process, once an offer has been accepted. In our region, collection escrow companies receive payments from the buyer on behalf of the seller, handle accounting procedures, then forward payments to the seller, often by direct deposit or via a mailed check. Why is this convenient? Because both parties then have a state-licensed firm keeping track of payments. This also makes it easier around tax time for buyer and seller, as they can receive a printout of payments made or received for accounting purposes. Sellers can more easily show income and buyers can better account for their mortgage interest deduction.

Check out the podcast version of this article here:

Thinking about using Oregon seller financing? Contact expert Oregon Realtor Roy Widing with Certified Realty for more information about this helpful real estate tool. For free answers to your questions, call or text Roy at 971-258-4822, or email him at Roy@CertifiedRealty.com

Thinking about using Oregon seller financing? Contact expert Oregon Realtor Roy Widing with Certified Realty for more information about this helpful real estate tool. For free answers to your questions, call or text Roy at 971-258-4822, or email him at Roy@CertifiedRealty.com

You must be logged in to post a comment.