As a seasoned Realtor approaching my 37th year in real estate, I’m often asked what to expect in the next year.

I’m optimistic for 2025. Why, you may ask? That’s because by focusing on economics (greatly affected by federal policy), we have tangible reason to believe lower energy prices and taming inflation will be goals of the new administration. Some added evidence can be found in their track record from 2016-2020, when interest rates hovered around 3%.

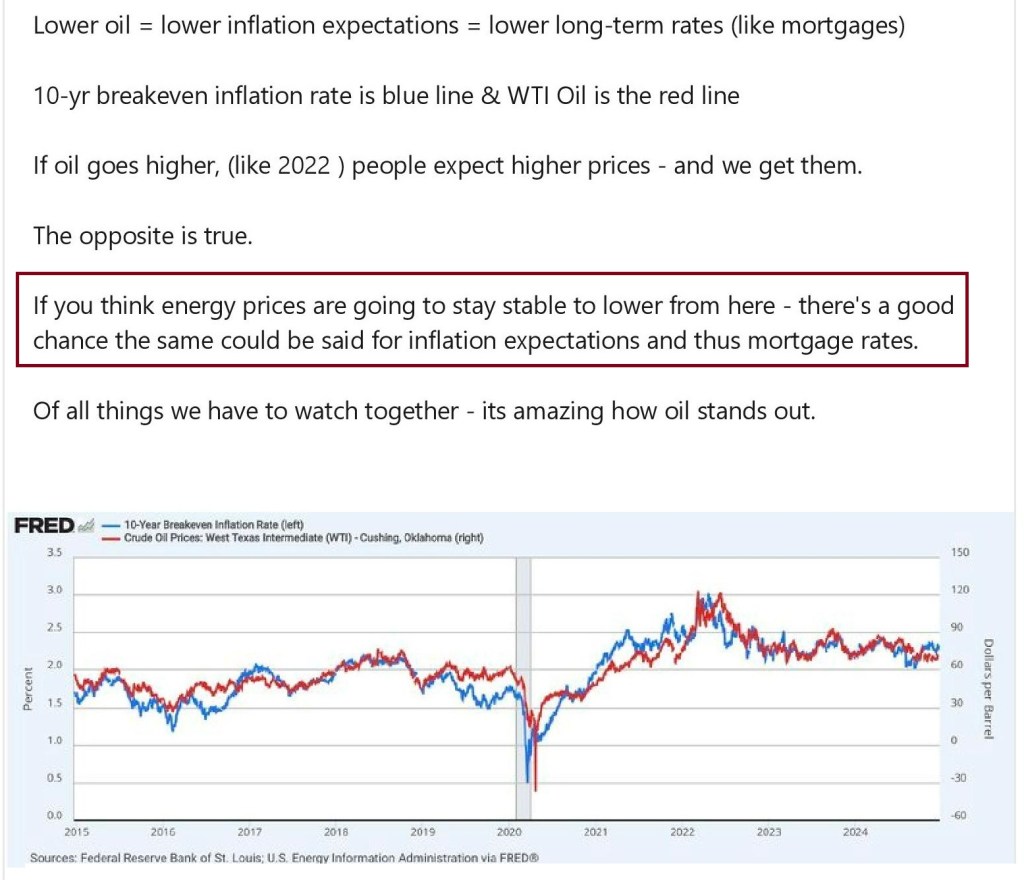

Rising inflation and higher energy prices could be considered hidden taxes that make things more expensive and affect interest rates. Lower interest rates are like gasoline in the American engine. As a result, lower energy costs, reduced interest rates and less inflation all bode well for our economy looking forward. Others have said it in a more detailed fashion, so I leave you with the slightly wonky but highly informative post at the bottom of this page. Examine how closely energy prices correlate with inflation.

How does this all affect Oregon seller financing? Lower interest rates mean homes and real estate in general becomes more affordable. This helps both buyers and sellers who use Oregon owner financing. If you’re looking to buy or sell Oregon property this year, feel free to contact me and I’m happy to discuss your options as we navigate your best course during this exciting time. Here’s to a wonderful 2025!

Roy Widing, Realtor

Oregon Seller Financing Specialist

You must be logged in to post a comment.